Can Bridge Exploits be a Thing of the Past deBridge Thinks so

For all of the beautiful things the world of crypto is building towards, its not without its setbacks. From the UST depeg, FTX and more, there are more than enough ways to get the rug pulled from under your feet. For every opportunity to make life changing gains, there is something lurking around the corner to take it all back. Crypto is truly still the wild west, at least for now. In recent years, hackers have been able to exploit protocols and get away with billions in TVL. One thing is for sure, in order to drive further liquidity into this ecosystem, institutions have to be ensured that the protocol liquidity they provide will not get drained by malicious actors. Many players in the space are working to build stronger moats around these huge swaths of TVL, but what if there was a better way?

2022 was a Bad Year for Bridges

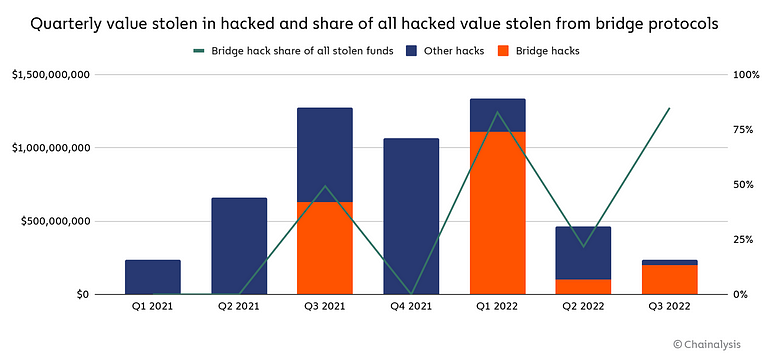

Before we dive into the potential future that deBridge have envisioned, I think its important we take a look at how we ended up here. In the last 2 years, bridge exploits have amounted to over $2.5 billion in losses. In February of 2022, Wormhole suffered a $350 million exploit. Just a month later the Ronin bridge fell victim to a $650 million exploit as well. Both of these hacks were similar in nature. The hackers targeted the huge pools of liquidity that allow these bridges to facilitate the movement of assets across chains.

Bridge Exploits by Volume

If you are new to crypto, the idea of 1 billion dollars being hacked and stolen in the span of a month probably sounds ridiculous, and you would be right. But how is this even possible? Its important that we understand how bridges work and why they are important to the broader crypto ecosystem before we can answer that.

How do Bridges Work?

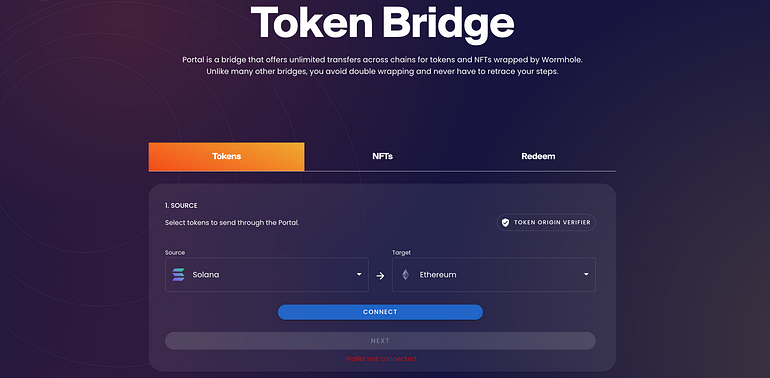

Lets take Wormhole for example. Wormhole is a decentralized, universal message-passing protocol that connects to multiple blockchains. Wormhole allows different blockchains like Ethereum, Binance Smart Chain, Solana, Polygon, and Avalanche to communicate with each other. Crypto has an interoperability problem. Assets and liquidity on one blockchain may not be used on another blockchain. You can&rsquot just send USDC from the Ethereum network to Solana. But this is why bridges exist. Some protocols use bridges like Wormhole in the background giving the user a better experience. Wormhole works by holding a large amount of liquidity from multiple chains. This is what we call TVL (Total Value Locked). A user can deposit assets from one chain, and receive the corresponding assets on another. Wormhole acts as the messenger between blockchains, and the escrow service that allows all of this to happen. Unfortunately there are 2 problems with conventional bridges like Wormhole:

- They are slow

- They are enticing for hackers to exploit

Portal Bridge powered by Wormhole

Most cross chain bridges take around 20 minutes to complete these transactions, which is much too long in the world of crypto. But worst than that, because they need huge amounts of TVL to ensure large cross chain swaps without high slippage, hackers are constantly trying to exploit them because the reward for doing so is HUGE.

deBridge has the Solution

deBridge is a cross-chain interoperability and liquidity transfer protocol that has truly decentralized frameworks. It also used the classical approach of locked liquidity and wrapped assets, and has processed 110k+ transactions from over 60k unique users earning $180k+ in total fees to date. But did the team at deBridge stop there? No! The team has made the courageous move to continue to innovate and they have built a new solution that can alleviate the issues plaguing traditional bridges to date.

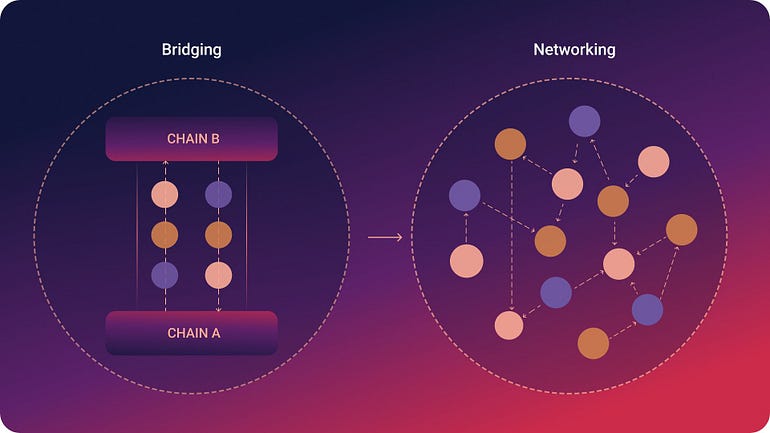

Recently, the deBridge team has announced the deSwap Liquidity Network (DLN). DLN is a cross-chain value transfer protocol built on top of deBridge, introducing an all-new liquidity on demand approach that solves the challenges of the classical continuously locked liquidity model.

By removing the need for locked liquidity, DLN can enable all of this for end-users and protocols that integrate with deBridge low fees, 0 slippage, faster settlement and cross chain limit orders. DLN is a trustless network where anyone can generate sustainable rewards on idle liquidity, without token incentives! Market makers, quants, protocols, DAOs, and anyone holding on-chain liquidity can join for an additional monetization channel.

deSwap Liquidity Network will enable limitless, zero slippage transfers of value across chains with 0 TVL, enabling secure and efficient transfers of value and messages simultaneously, powered by deBridge. Oh yeah! Did I mention that you can trade ANY asset on one chain for any other asset on another? Its like a mix of Wormhole and Uniswap all in one!

In Conclusion: The end of Bridge Exploits is Near!

The idea that bridges need locked liquidity to operate seamlessly may be looked upon in the future as one of the many silly decisions that the crypto industry as a whole decided to explore. DLN allows for institutions to earn fees on cross chain swaps (putting their liquidity to work) without the need to lock up their assets and risk them to an exploit. Users get quicker swaps for cheaper. Its a win-win for everybody except you hacker-man! It looks like we already have the solution and now we just need to get the (cross-chain) message out! I have been using deBridge for all my cross-chain swaps to date, and if you are looking for a more seamless experience you should give them a try!

Disclaimer: I am an investor in a deBridge private round.

Top News

Press Releases

Payments

New Payment Limit For Crypto Wallets Scrapped

The recent Anti-Money Laundering re... Read more

Bitcoin

Bitcoin Undergoes Price Correction As International Economies

A significant portion of the crypto... Read more

Join Our Newsletter

Get the latest trends and updates on our crypto community.